Carmignac Sécurité: the Fund Manager’s thought

The monetary and fiscal policies that took shape during the second quarter fully delivered their effects on financial markets in the third.

The assurance that the ECB would unfailingly buy financial assets, combined with the European Union’s pledge to cover part of member states’ financing needs as of 2021, was enough to keep German bond yields steady during the quarter. 5- and 10-year Bunds traded within a 15-basis-point range and ended the quarter practically where they had started, which was –0.50% in the case of 10-year paper. This stability at markedly negative yields was what convinced us to hold no substantial positions in that market segment over the period.

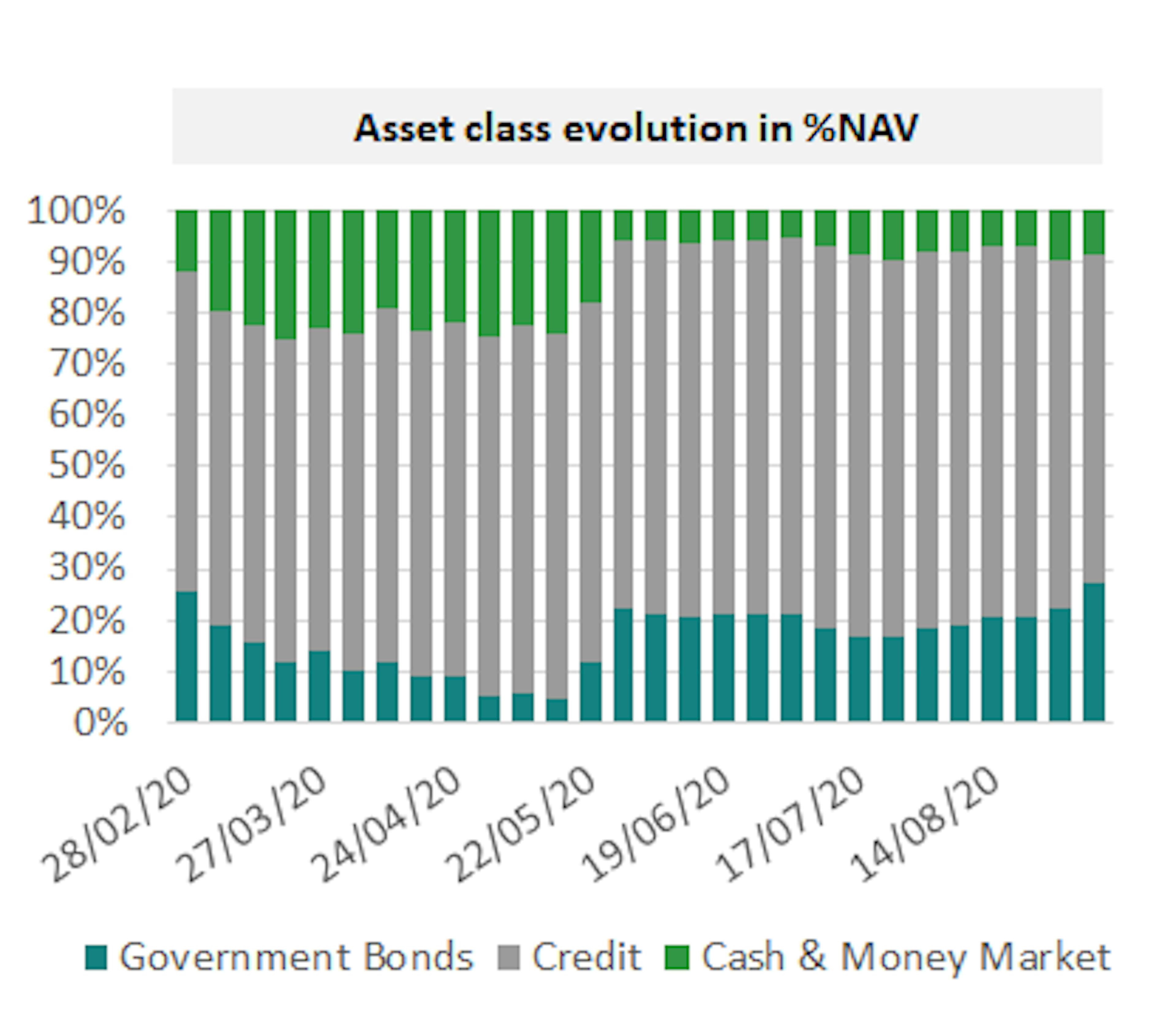

A different picture emerges, however, when you consider other eurozone countries, particularly those offering significant credit spreads at a time of negative interest rates – i.e., Italy, Greece, Portugal, Cyprus and Spain. Bond yields in those countries fell consistently throughout the summer. Those on Italian 10-year issues shrank from 1.3% to almost 0.7%. In response, we at Carmignac Sécurité stayed highly active in this corner of the fixed-income market, beefing up our holdings of sovereigns from Southern Europe and extending the maturities on them to between 5 and 7 years. After the summer rally, we scaled back those positions, notably by selling off the shortest-maturity bonds paying negative yields. At the end of September, Italian sovereign and quasi-sovereign debt accounted for the bulk of our government bond portfolio.

The other big winner in this policy mix has been corporate credit

Despite the unprecedented economic slump, companies managed from early April onwards to secure the funding they needed via primary issues. Our Fund invested extensively in them to access the relatively high yields on offer. Once the worst was over, the low overall level of so-called risk-free rates, combined with central-bank support through asset purchases, made it possible for corporate credit to book solid performance.

We mainly sold the longest maturities in our portfolio on negative-yielding bonds, as well as on issues that didn’t enjoy direct ECB support (chiefly bank bonds and bonds from non-eurozone issuers). At the same time, we have maintained our strong convictions on companies directly affected by the economic and public health crisis despite having extremely healthy balance sheets, which give them the cushioning needed to weather the storm.

Names that come to mind include Easyjet and Airbus in aviation, the Carnival cruise line and Pemex in the energy sector.

In the last quarter of 2020, we will be in for a number of developments that stand a good chance of surprising the market. The US presidential election, Brexit and a possible vaccine all have the potential to make financial asset prices more volatile. By reducing portfolio risk while holding onto several strong convictions, we at Carmignac Sécurité should have the agility required in such an environment.

Performance

| Carmignac Sécurité | 2.1 | 0.0 | -3.0 | 3.6 | 2.0 | 0.2 | -4.8 | 4.1 | 5.3 | 1.0 |

| Indice di riferimento | 0.3 | -0.4 | -0.3 | 0.1 | -0.2 | -0.7 | -4.8 | 3.4 | 3.2 | 0.5 |

| Carmignac Sécurité | + 3.0 % | + 1.5 % | + 1.0 % |

| Indice di riferimento | + 0.8 % | + 0.2 % | + 0.1 % |

Fonte: Carmignac al 28 feb 2025.

Le performance passate non sono un'indicazione delle performance future. Le performance sono calcolate al netto delle spese (escluse eventuali commissioni di ingresso applicate dal distributore)

Indice di riferimento: ICE BofA 1-3 Year All Euro Government index

- Keith Ney arrival (22/01/2013). Performance Indicator: EuroMTS 1-3 years index (EUR). Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Carmignac Sécurité AW EUR Ydis

- Periodo minimo di investimento consigliato

- 2 anni

- Livello di rischio*

- 2/7

- Classificazione SFDR**

- Articolo 8

*Scala di Rischio del KID (documento contenente le informazioni chiave). Il rischio 1 non significa che l'investimento sia privo di rischio. Questo indicatore può evolvere nel tempo. **Il Regolamento SFDR (Regolamento sull’informativa di sostenibilità dei mercati finanziari) 2019/2088 è un regolamento europeo che impone agli asset manager di classificare i propri fondi in tre categorie: Articolo 8: fondi che promuovono le caratteristiche ambientali e sociali, Articolo 9 che perseguono l'investimento sostenibile con obiettivi misurabili o Articolo 6 che non hanno necessariamente un obiettivo di sostenibilità. Per ulteriori informazioni consultare: https://eur-lex.europa.eu/eli/reg/2019/2088/oj?locale=it. Per le informazioni relative alla sostenibilità ai sensi del Regolamento SFDR si prega di prendere visione del prospetto del oppure fondi delle pagine del sito web di Carmignac dedicate alla sostenibilità fondo https://www.carmignac.it/it_IT/i-nostri-fondi).

Principali rischi del Fondo

Recenti analisi

Fondi obbligazionari target maturity: La storia continua con Carmignac Credit 2031

Carmignac amplia la gamma dei fondi target maturity