Funds in Focus

Carmignac Sécurité: Q2 2020 overview

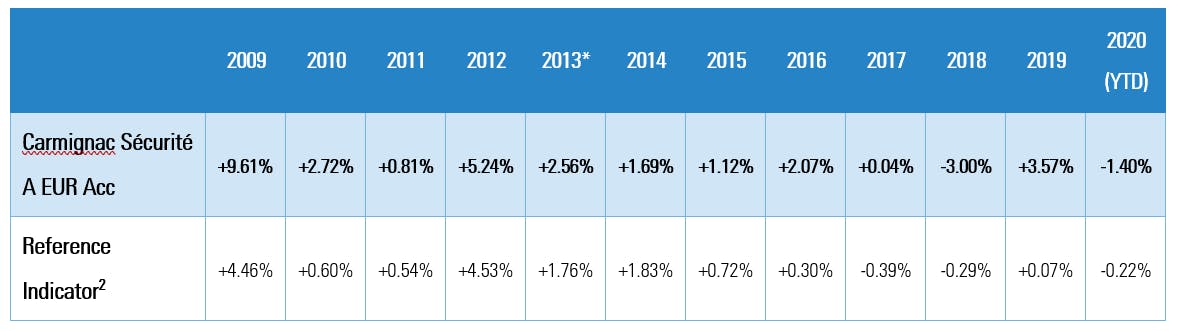

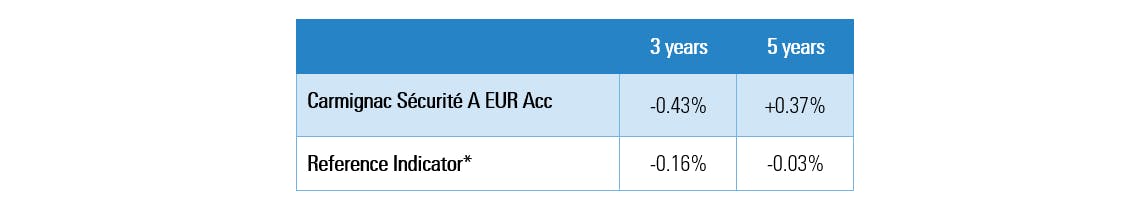

In the second quarter of 2020, Carmignac Sécurité increased by +3.10%, while its reference indicator increased by +0.26%. For the first half of the year, the Fund posted a performance of -1.40%, while its reference indicator was down -0.22%1.

What happened?

The second quarter of 2020 saw an unprecedented effort by central banks and governments to try to limit the negative economic fallout from the Covid-19 pandemic.

It isn’t so much the sheer amounts involved (nearly 20% of the GDP of developed countries injected by governments in fiscal stimulus or in loans and guarantees, to which must be added an increase in the balance sheets of central banks also of nearly 20% of GDP) as the simultaneous action by monetary and fiscal authorities that makes this response so striking.

There have been differing reactions from economic agents, depending on whether they are investors or issuers. Beginning in late March, companies were above all concerned with building up enough of a cash buffer to be able to weather weeks or even months of close to zero revenue. And to make sure that cash would be forthcoming, they were willing to pay much more to access it than they had prior to the crisis. Investors, meanwhile, interpreted the combined action of central banks and governments as a sort of licence to invest in risk assets like credit and equities – reasoning that they would be in the company of investors with unlimited resources.

How did we manage the Fund?

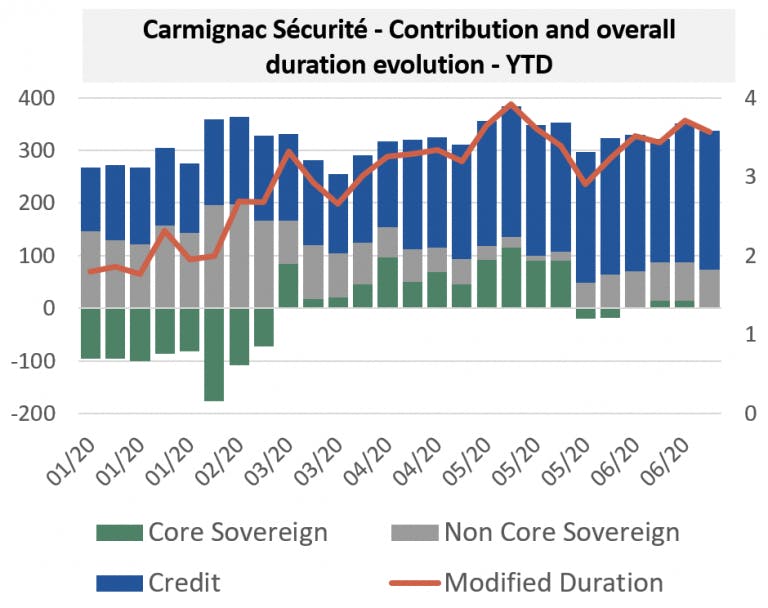

At Carmignac Sécurité, we therefore shifted our holdings in April and May out of government paper and into corporate bonds.

A constant feature of our second-quarter portfolio was a larger credit allocation, initially driven by the sizeable spreads to be had in the primary market. But the new situation also opened up opportunities in sectors that were particularly hard-hit by the public health crisis. In response, the Fund made targeted investments in leisure industry providers, airlines and carmakers, where the bonds of companies suffering unwarranted selloffs in relation to their fundamentals could be snapped up at bargain prices. Carnival Cruise Lines, the air carrier Easyjet and Ford offered extremely good value for money through April and May, for example.

On the whole, we took advantage of the second quarter to step up our carry-trade strategy so as to put in place adequate drivers of future returns.

-

Corporate credit accounted for nearly 66% of our portfolio at the end of the quarter (with 9% going to speculative-grade bonds) and almost two thirds of our duration risk (2.6 out of a total modified duration of 3.7).

-

In terms of sovereign debt, the second quarter can be divided into two distinct periods. The first one, covering April and May, was devoted to scaling back our allocation to issuers on the eurozone periphery. Economic lockdown and the swift responses to it by national governments cast doubt on our previous case for overweighting those investments. By mid-May, we had closed virtually all of our positions in those geographies.

The second phase coincided with a transition from national to increasingly Europe-wide crisis-fighting measures, along with the ECB’s announcement of highly favourable borrowing terms for banks. This convinced us to engineer a substantial return to short-dated eurozone peripheral sovereign bonds (mainly Italian and Portuguese). Our holdings in core countries (not only Germany, but also the United States and Australia) went in the opposite direction. As we started the quarter with the idea that the crisis would pull interest rates down, we steadily sold off those securities in order to focus our exposure on corporates and eurozone peripheral sovereigns.

Our performance in the second quarter was primarily attributable to a gradual tightening of credit spreads and the carry of the portfolio, which now accounts for 1.5%. Core government bond rates ended the period near their April level, resulting in a near-neutral impact on our second-quarter return.

We are therefore entering the third quarter with a portfolio heavily weighted towards investments offering much greater carry than at the beginning of the year, and buttressed by bottom-up analysis of specific issuers operating under special circumstances. Though volatility might pick up mildly going forward, our second-quarter performance drivers still hold out potential for spread compression and highly attractive carry.

*Keith Ney arrival (22/01/2013). 2 EuroMTS 1-3 years index (EUR). Source: Carmignac, 30/06/2020. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Carmignac Sécurité

Main risks of the Fund:

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

RISK OF CAPITAL LOSS: The portfolio does not guarantee or protect the capital invested. Capital loss occurs when a unit is sold at a lower price than that paid at the time of purchase.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. A EUR Acc share class ISIN code: FR0010149120.

Source: Carmignac, 30/06/2020.

1 Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. Performances are net of fees (excluding possible entrance fees charged by the distributor).