Carmignac target maturity fixed income funds: The story has just begun

Since the bond crisis of 2022, credit markets have emerged as the big winners in the fixed-income spectrum. Boosted by high carry and attractive valuations following the market shock, this asset class has won over new investors, delivering absolute returns often in the double-digit territory. Now is the time to take stock and look ahead to the future of this asset class.

Double digit returns achieved with low single digit standard deviation

Since 2020, our range of target maturity fixed income funds have delivered an outstanding performance, as demonstrated by the recent success of Carmignac Credit 2029, which delivered a +12.63% performance in its first year of existence, while maintaining a contained risk profile with an average portfolio risk of BBB.

Over a longer investment horizon, Carmignac Credit 2027 has generated a compelling performance of +22.04% since 30/06/2022, while the investment-grade credit index has returned only +10.07% over the same period. Our first fund, Carmignac Credit 2025 has also delivered better performance than its performance objective1 since inception.

Our target maturity fixed income funds have delivered a daily volatility that is 2 to 3 times lower than other bond segments (see graphic 1 below).

On the back of this success, our 3 target maturity fixed income funds have reached €2.9 billion in assets under management2. More than ever, we believe active management is crucial in order to take full advantage of credit markets to build attractive portfolios on a risk/return basis.

Graphic 1: One-year performance and volatility of our target maturity fixed income funds against market indices

Target maturity funds: pertinent performance engine for an allocation

We offer opportunistic investment vehicles that aim to seize opportunities across the credit spectrum. Nevertheless, our 3 target maturity funds are managed with very strict guidelines, with a pre-determined investment horizon, strong diversification (more than 250 lines in the portfolio at cruise speed), full currency hedging in euros, and a focus on quality issuers.

Our target maturity funds are also easy to use for portfolio construction. We have a wide investment universe (US credit, Euro credit, emerging credit, financial debt, structured credit) and highly diversified portfolios, enabling us to keep the funds open to subscriptions and redemptions on a daily liquidity basis throughout the life of the fund.

Thanks to their generous embedded yields and high average ratings, our target maturity strategies enable us to absorb adverse market scenarios that could present themselves to us in the future, both in terms of widening credit margins and rising interest rates (see graphic 2).

Graphic 2: 12 months performance scenario for Carmignac Credit 2029 depending of credit spreads and yield fluctuations

A simple and successful recipe unchanged for four years

Our credit team is composed of three fund managers who have demonstrated their ability to generate performance in a wide range of market conditions. They combine experience in traditional credit, structured credit, special situations and have been working together since 2015.

Their investment process and DNA of our target maturity strategies stem directly from our flagship fund, Carmignac Portfolio Credit, which has won numerous awards and received 5-star ratings from Morningstar and Quantalys. We have been awarded a platinum rating by Citywire for our expertise in corporate bonds3.

Our investment process is based on the selection of opportunities whose fundamental risk is overestimated by investors. We believe in active management and alpha generation and we try to optimize our performance by adding and pruning opportunities when we can improve the risk-return profile of the fund, always keeping in mind the target maturity. As demonstrated in graphic 3, this enables us to deliver returns that exceed the headline yields of our portfolios.

Finally, our funds benefit from robust portfolio construction, enabling them to achieve average investment grade ratings. We attach a great importance to environmental, social and governance criteria: our Carmignac Credit 2027 and Carmignac Credit 2029 funds are in line with Article 8 of the SFDR directive4.

Graphic 3: Contribution to Carmignac Credit 2029 performance since inception

Strong performance potential for the future

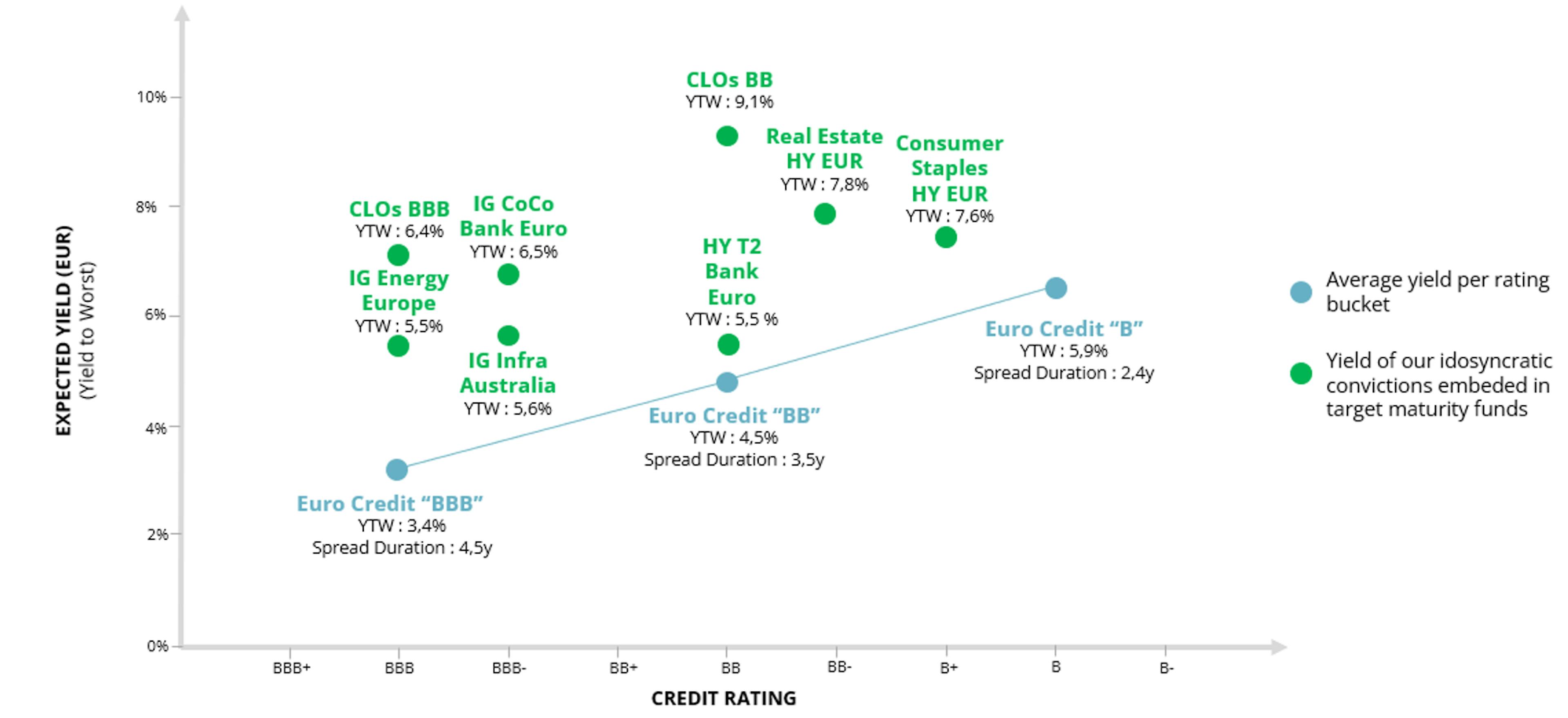

Credit markets are now richly valued thanks to the tightening of credit spreads we have seen since 2022, but dispersion is high and we see many pockets of value that we believe will deliver attractive risk-adjusted returns (see graphic 4).

We remain highly optimistic about sectors such as financials and energy, which are abundant in issuers with robust cash flows generation and solid fundamentals, but which suffer from investors' lower appetite and thus provide extra yield.

Our expertise in structured credit through investments in CLO tranches is also a high added value, since the tranches in which we invest have a very low accident rate, a short duration and a higher yield than traditional instruments.

Finally, the primary markets have been particularly buoyant in recent months, with new issuers that are not well known to the investor base raising capital. We are regularly finding very attractive opportunities in these issues, which should bolster our funds' returns in the future.

For the months ahead, we are confident in our ability to deliver high future performance while maintaining a prudent level of risk with highly diversified portfolios.

Graphic 4: Examples of opportunities benefiting from credit dispersion embedded in our target maturity fixed income funds

Carmignac Credit 2027 A EUR Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 1,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,04% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- There is no performance fee for this product.

- Transaction Cost

- 0,12% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Credit 2027 | 1.7 | 12.8 | 7.2 | 1.0 |

| Carmignac Credit 2027 | + 7.1 % | - | + 8.0 % |

Source: Carmignac at 28 Feb 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: -

Carmignac Credit 2029 A EUR Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 1,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,14% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance when the unit outperforms its annualised performance objective by 4.22% during the performance period. Any underperformance is recovered over 5 years. The actual amount will vary depending on how well your investment performs. The estimate of aggregated costs above includes the average for the last five years, or since the creation of the product if it is less than five years old. If the outperformance is constituted, the commission will be collected no earlier than December 2024.

- Transaction Cost

- 0,13% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Credit 2029 | 5.3 | 8.0 | 1.6 |

| Carmignac Credit 2029 | + 8.8 % | - | + 11.2 % |

Source: Carmignac at 28 Feb 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: -

Related articles

Carmignac Portfolio Credit is awarded best Fund in Europe by Lipper for the fourth year in a row

Fixed income target maturity funds: The story continues with Carmignac Credit 2031

Carmignac extends succesful target maturity Fund range

Marketing Communication. Please refer to the Key Information Document (KID) /prospectus of the fund before making any final investment decisions. The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in French, English, German, Dutch, Spanish, Italian on the Carmignac website, regulatory information section, at § 6 entitled "summary of investor rights. This document is published by Carmignac Gestion S.A., a portfolio management company approved by the Autorité des Marchés Financiers (AMF) in France, and its Luxembourg subsidiary Carmignac Gestion Luxembourg, S.A., an investment fund management company approved by the Commission de Surveillance du Secteur Financier (CSSF), pursuant to section 15 of the Luxembourg Law of 17 December 2010. “Carmignac” is a registered trademark. “Investing in your Interest” is a slogan associated with the Carmignac trademark. This document does not constitute advice on any investment or arbitrage of transferable securities or any other asset management or investment product or service. The information and opinions contained in this document do not consider investors’ specific individual circumstances and must never be interpreted as legal, tax or investment advice. The information contained in this document may be partial and could be changed without notice. This document may not be reproduced in whole or in part without prior authorisation. The risks, fees and ongoing charges are described in the KID. The prospectus, KID, the net asset-values and the latest (semi-) annual management report may be obtained, free of charge, in French, English, German, Dutch, Spanish, Italian, from the management company. The subscriber must read the KID before each subscription. The Funds present a risk of loss of capital. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds commun de placement or FCP) are common funds in contractual form conforming to the UCITS Directive under French law. Access to the Fund may be subject to restrictions regarding certain persons or countries. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA. Morningstar RatingTM: © 2023 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. UK: This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd and is being distributed in the UK by Carmignac Gestion Luxembourg. ". Switzerland: the prospectus, KIIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon. Belgium: These materials may also be obtained from Caceis Belgium S.A., the financial service provider, at the following address: avenue du port, 86c b320, B-1000 Brussels. In case of subscription in a French investment fund (fonds commun de placement or FCP), you must declare on tax form, each year, the share of the dividends (and interest, if applicable) received by the Fund. A detailed calculation can be performed at www.carmignac.be. This tool does not constitute tax advice and is intended to serve solely as a calculation aid. This does not exempt from having to perform the procedures and verifications incumbent upon a taxpayer. The results indicated are obtained using data that the taxpayer provide, and under no circumstances shall Carmignac be held responsible in the event of error or omission on your part. Pursuant to Article 19bis of the Belgian Income Tax Code (CIR92), in the case of subscription to a Fund that is subject to the Savings Taxation Directive, the investor will have to pay, upon redemption of his or her shares, a withholding tax of 30% on the income (in the form of interest, or capital gains or losses) derived from the return on assets invested in debt claims. Distributions are subject to withholding tax of 30% without income distinction. The net asset values are available on the website www.fundinfo.com. Any complaint may be referred to complaints@carmignac.com or CARMIGNAC GESTION - Compliance and Internal Controls - 24 place Vendôme Paris France or on the website www.ombudsfin.be.

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél: (+33) 01 42 86 53 35 Investment management company approved by the AMF Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel: (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF Public limited company with share capital of € 23,000,000 - RCS Luxembourg B 67 549.