Flash Note

Carmignac Sécurité: Letter from the Fund Manager

Q1 2021

In the first quarter of 2021, Carmignac Sécurité1 withstood the headwinds buffeting the fixed-income market, returning +0.30% as of end-March 2021 compared to a negative performance of -0.24% for its reference indicator2. A flexible investment approach and cautious portfolio construction enabled us to take rising yields in our stride.

The Bond Market Today

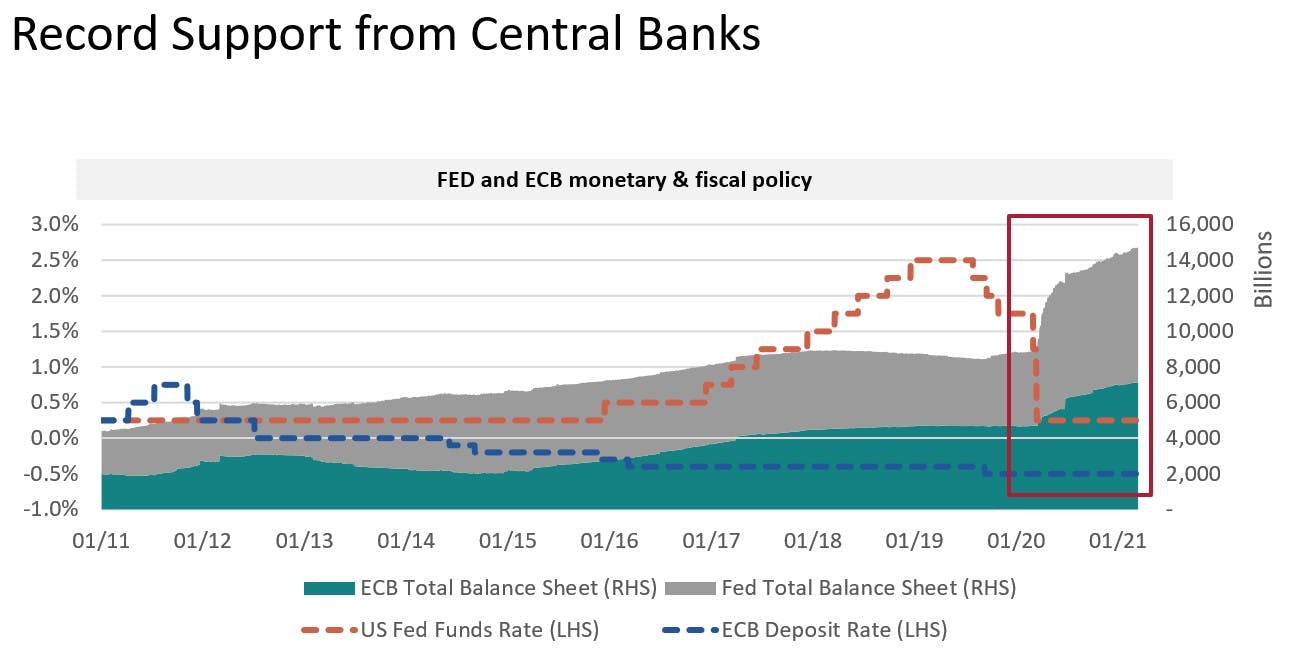

A combination of continued monetary-policy easing, expansionary fiscal policies (even more so since the Democrats gained control of the US Senate) and the ramp-up of vaccination campaigns (with the possible exception of the eurozone) understandably pushed nominal yields up, especially on longer-dated bonds (leading to a steeper yield curve). That trend was particularly pronounced in the countries that have made the most progress in terms of re-opening and massively boosting the economy – meaning the US and the UK among core countries.

Though core eurozone interest rates followed suit (e.g., the yield on Germany’s 10-year paper went from –0.55% to –0.29% over the first quarter of 2021), the upward trend was muted by the region’s slower vaccine rollout and delayed re-opening of the economy. Spreads within the currency bloc initially continued to narrow. As bond investors were encouraged by the appointment of Mario Draghi to head the government in Rome, the 10-year spread on Italian bonds in relation to German bonds hit a low of 90 basis points, before stabilising at the end of the period. But the spread compression was too small to offset in full the uptick in core interest rates, with the result that the upward movement pretty much extended to rates across the eurozone.

The central banks nonetheless kept a level head. While for the most part reiterating their commitment to highly dovish policies (stressing that their economies were still far from reaching their inflation and full-employment targets), they showed they were rather at ease with the trend towards rising interest rates. This led to a welcome increase in inflation expectations and higher economic growth.

In corporate credit (excluding banks), primary issues exceeded the €100 billion mark, making this the third busiest quarter ever recorded in the euro market. Most of it had longer maturities, given the abundant short-term liquidity being provided by the ECB. In another development reflecting continuity with the preceding quarters, issuance of ESG bonds with a variety of labels (green, sustainable, SRI, etc.) rose sharply in the first quarter. In this case too, even though spreads tightened over the period (particularly in the sectors hardest-hit by the pandemic), it wasn’t enough to offset the increase in the risk-free rate.

All in all, the bond market was down significantly in the quarter except in the high-yield space, which have a lower sensitivity to interest rate risk and higher spreads that better cushioned the rise in rates.

Portfolio Allocation

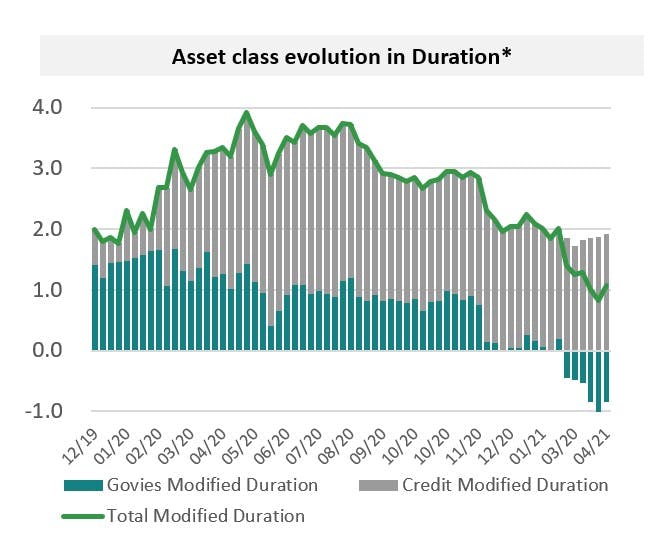

We continued throughout the quarter to adjust the Carmignac Sécurité portfolio to this new state of play. In January, we maintained or even stepped up our short positions in core-country sovereigns. We primarily sold bonds from countries further along in the economic recovery (e.g., the US, the UK and Norway), as well as from the Czech Republic and Poland in Eastern Europe. Then, in late February, we reduced our duration in countries on the eurozone periphery, most significantly by cutting our exposure to Italy. We also scaled back our corporate-bond holdings in terms of both weight in our portfolio and duration, though at the end of March our investments in that space picked up mildly as rising yields created new carry opportunities. We ended the quarter with total modified duration of 1 (down from 2 at the start of the year), due to our continued bullish expectations for the economy, which will likely prove detrimental to fixed income.

Outlook

In the months to come, we plan to stick with a portfolio construction that generated positive performance in the first three months of 2021. The bulk of our government-bond shorts may well shift from the US and UK to the eurozone, which we believe will catch up in terms of yields as the bloc catches up in vaccination rates and the re-opening of the economy.

We are hewing to our cautious stance on credit, particularly on the long end of the yield curve where the spreads on offer struggle to offset rising interest rates. However, the high dispersion that characterises the fixed-income market still offers actively managed funds like Carmignac Sécurité opportunities to find investments with real added value.

Carmignac Sécurité

Flexible, low duration solution to challenging European markets

Low duration euro fixed income Fund.

Flexible and active approach with a modified duration range from -3 to +4

- Limited exposure to credit risk with a minimum average rating of investment grade.

Carmignac Sécurité AW EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Sécurité AW EUR Acc | +1.69 % | +1.12 % | +2.07 % | +0.04 % | -3.00 % | +3.57 % | +2.05 % | +0.22 % | -4.75 % | +4.06 % | +5.10 % |

| Reference Indicator | +1.83 % | +0.72 % | +0.30 % | -0.39 % | -0.29 % | +0.07 % | -0.15 % | -0.71 % | -4.82 % | +3.40 % | +3.16 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Sécurité AW EUR Acc | +1.42 % | +1.29 % | +0.98 % |

| Reference Indicator | +0.41 % | +0.12 % | +0.11 % |

Scroll right to see full table

Source: Carmignac at 29/11/2024

| Entry costs : | 1,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,11% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | There is no performance fee for this product. |

| Transaction Cost : | 0,24% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

1 Carmignac Sécurité A EUR Acc (ISIN: FR0010149120).

Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. The portfolios of Carmignac funds may change without previous notice. Performances are net of fees (excluding possible entrance fees charged by the distributor). Annualized performance as of 31/03/2021.

2 Reference indicator: ICE BofA ML 1-3 Y Euro All Government Index (EUR). Since 31/12/1998 (Date of creation of the Euro and the Euro MTS 1-3 years index). Until 31 December 2020, the reference indicator was the Euro MTS 1-3 years. Performances are presented using the chaining method.

Carmignac Sécurité AW EUR Ydis

Recommended minimum investment horizon

Lower risk Higher risk

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

RISK OF CAPITAL LOSS: The portfolio does not guarantee or protect the capital invested. Capital loss occurs when a unit is sold at a lower price than that paid at the time of purchase.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

The Fund presents a risk of loss of capital.