Flash Note

![[Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

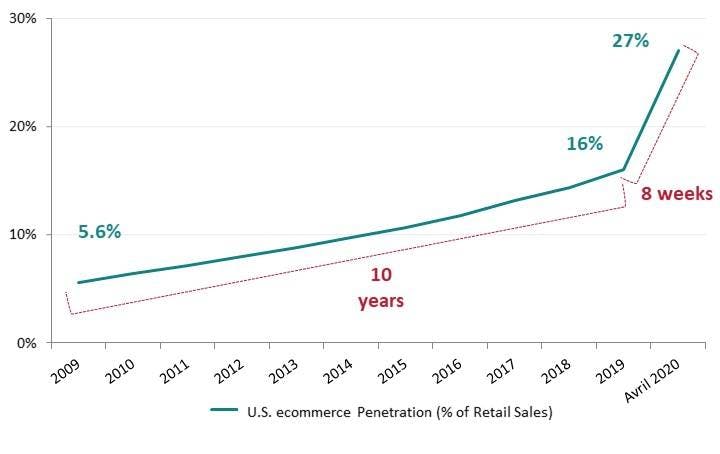

e-commerce: Things change slowly... until they change fast

4 trends to keep in mind

-

27% e-commerce penetration rate

It took e-commerce 10 years to go from 6% to 16% of total retail sales in the US, but just 8 weeks to go from 16% to c. 27%.

-

Source: Bank of America, US Department of Commerce, ShawSpring Research, 05/2020

-

x2 for online grocery

The big shift to online has been in groceries. While Amazon is one of the big winners in this space, even legacy players like Walmart (the largest grocer in the US) have seen their online grocery sales climb to 9.2% of the total, vs 5.9% last year.

-

![[Insights] 2020 06_Fund_CI 2](https://carmignac.imgix.net/uploads/article/0001/12/thumb_11575_article_mobile.jpeg?auto=format%2Ccompress)

Source: BAC internal data, 05/2020 Source: BAC internal data, 05/2020

-

Investment is accelerating

Facebook, Amazon and Shopify are accelerating their investments in the midst of a crisis while others shrink/retreat. This will have long-term consequences.

-

We’ve seen two years’ worth of digital transformation in two months

Microsoft CEO

2030 has been pulled forward to 2020

Shopify COO

-

Social medias develop online shopping

Thinking and investing in a forward-looking way. Though Instagram was the first social media to develop "social shopping", Facebook just unveiled a service a few days ago that puts it in direct competition with Amazon and eBay.

-

“Facebook Shops” will allow sellers to create digital storefronts on Facebook or Instagram. ![[Insights] 2020 06_Fund_CI 3](https://carmignac.imgix.net/uploads/article/0001/12/thumb_11583_article_mobile.jpeg?auto=format%2Ccompress)

Source: Financial Times, 05/2020 Source: Financial Times, 05/2020

The crisis has strongly supported our long-term exposure to this segment leading us to tactically take our profits as it has become a “crowded” trade. However, e-commerce and indirect plays on e-commerce (like fintech) still account for more than 27% of Carmignac Investissement.

Carmignac Investissement

Main risks of the Fund

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

* Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. A EUR Acc share class ISIN code: FR0010148981.