Addressing Trump 2.0 and DeepSeek with diversification and convictions

Carmignac Investissement focuses on companies around the world that create value through innovation, technology and/or a unique product offering without neglecting the search for profitability. One of the Fund's key strengths in the Trump 2.0 era is its diversified nature, which does not restrict itself to a specific investment style and fully adopts a flexible approach across all sectors and regions.

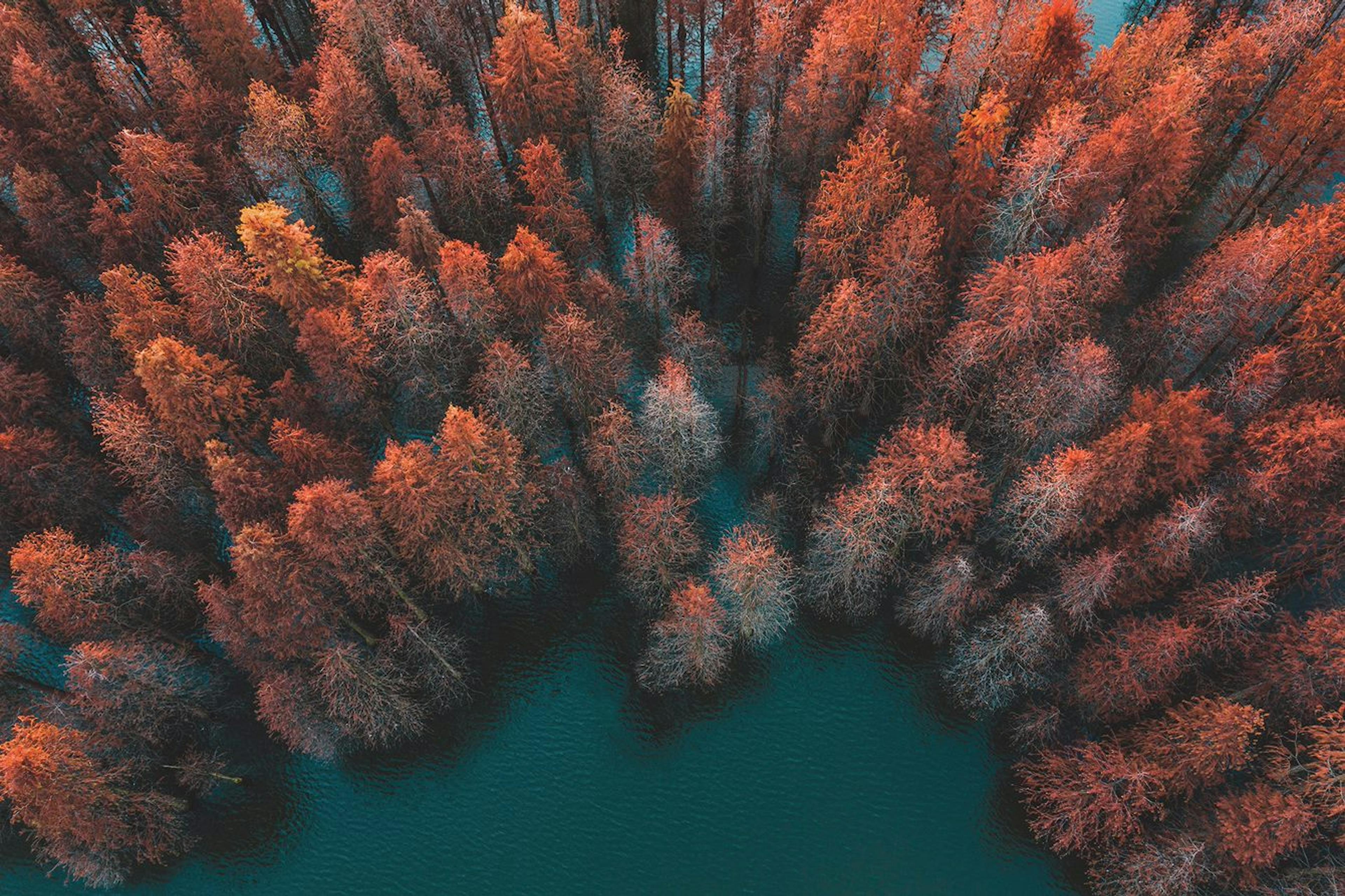

Example of geographical diversification of Carmignac Investissement

2025: Addressing Challenges Through Diversification

We believe that the fundamentals for equities in 2025 remain solid, underpinned by resilient US growth, continued accommodative monetary policies, and an expected 14% rise in S&P 500 corporate earnings, with margins at historic highs.

However, increased volatility is to be expected. Current valuations already incorporate much of the good news, which is making investors increasingly nervous, as illustrated by the recent violent market reaction in technology stocks following the DeepSeek announcement. On top of this, the volatility is further intensified by the unpredictability of Trump's announcements.

Given this landscape, we believe that exposure to equities should be maintained, but with a more diversified approach. While American exceptionalism may continue to dominate, some of its potential is already priced in. Nevertheless, there are still undervalued stocks in the US, notably in sectors that haven't participated in recent rallies, such as healthcare. There is also some potential for a recovery of emerging markets (EM) and Europe, where we are witnessing a broadly shared pessimistic sentiment and they can be currently bought at a discount compared to their American peers, providing a great portfolio diversifier.

Thus, geographic diversification is critical to navigating the complexities of the 2025 market. However, diversification should not lead to a dilution of convictions or a lack of directional strategy. Carmignac Investissement is full of strong convictions. The portfolio's top 10 positions reflect our strongest convictions in the largest caps, as illustrated by TSMC, which represents 9% of the Fund. Nevertheless, this concentration should not mask the diversity of the 58 other convictions that make up the portfolio, which are often off the beaten track.

Investing across diverse company profiles

Entering 2025, our investment strategy has evolved to embrace a more selective approach, acknowledging that valuation momentum may have reached its peak. As a result, our portfolio remains diversified and balanced between high-growth stocks with relatively high valuations, such as Nvidia, Amazon and Hermès, and stocks with more modest growth prospects but high visibility and attractive valuations, such as McKesson (a leading player in the distribution of medicines in the United States) and SK Hynix (a specialist in the production of memory chips).

This strategic reorientation has resulted in a gradual decline in the average price/earnings ratio (P/E) of our portfolio, from 30x at the beginning of March 2024 to 23x at the end of December 2024.

Investing across the value chain

We are convinced that artificial intelligence (AI) will remain one of the most attractive investment opportunities of the decade. However, recent volatility serves as a reminder of the concentration of investors in a limited number of stocks and raises potential doubts about the medium-term investment amounts in AI by certain players. It is therefore vital to diversify our exposure beyond Nvidia and the hyperscalers.

To do this, we are looking at the AI infrastructure value chain to identify niche but essential players. Taiwan is emerging as a significant hub in this field. The region is home to several key companies that are not only crucial to the AI infrastructure, but also profitable, offering attractive valuations. This is partly due to the geopolitical premium associated with the region.

Optimizing through sector diversity

Growth is not solely confined to the technology sector. The Fund's largest relative overweight is the healthcare sector. While our healthcare portfolio offers a cohort of companies with heterogeneous profiles, what they have in common is their capacity to generate stable earnings enabled by innovation, an ageing population and an increase in chronic diseases.

Carmignac Investissement also has substantial exposure to the industrial sector, exemplified by Prysmian (world leader in cables and systems for energy distribution) as well as to the financial sector (S&P Global, Block, Mastercard).

Looking beyond the large caps

The flexible nature of the Fund allows it to diversify beyond very large caps, investing in particular in mid and small caps (SMIDs), which offer several significant advantages. Firstly, it allows investors to benefit from specific local growth opportunities that are often overlooked. Secondly, it maximises exposure to the value chain, offering unique growth opportunities. Finally, these investments help to diversify the portfolio, reducing overall risk.

Our investments in SMIDs are predominantly in Asia, and to a lesser extent in the United States.

In Taiwan, for example, we have a portfolio of small and mid-caps with a sustainable competitive advantage and different profiles. These include:

- Companies that demonstrate robust intrinsic growth and optimize their operations to integrate new technologies continuously, such as Elite Material (manufacturer of essential materials for printed circuits) and Lotes (manufacturer of electronic interconnection components).

- Companies such as Gudeng Precision (supplier of integrated solutions for the handling, transfer and storage of semiconductors) are reaping benefits from the decoupling of the semiconductor supply chain between China and the United States, as well as from the increase in capital expenditure.

- Underestimated opportunities / idiosyncratic stories, such as Lite-On (world leader in semiconductors that convert light into electricity and vice versa.

Staying invested despite volatility

Even in times of market volatility, staying invested remains the best strategy for building long-term wealth. With Carmignac Investissement, we strategically manage portfolio volatility to ensure that annual fluctuations do not significantly impact long-term results. By balancing the portfolio, we aim to provide sustainable growth for our investors. As the Fund Manager for Carmignac Investissement, Kristofer Barrett would say: "Don't try to get rich quickly with equities. The more you're in a hurry, the less likely you are to succeed over the long term".

Carmignac Investissement A EUR Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 4/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 1,30% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Investissement | 2.1 | 4.8 | -14.2 | 24.7 | 33.7 | 4.0 | -18.3 | 18.9 | 25.0 | -7.7 |

| Reference Indicator | 11.1 | 8.9 | -4.8 | 28.9 | 6.7 | 27.5 | -13.0 | 18.1 | 25.3 | -5.4 |

| Carmignac Investissement | + 7.4 % | + 12.2 % | + 4.5 % |

| Reference Indicator | + 8.0 % | + 15.5 % | + 8.8 % |

Source: Carmignac at 31 Mar 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: MSCI AC World NR index

Carmignac Investissement Latitude A EUR Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 3/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 1,35% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Investissement Latitude | 1.3 | 0.3 | -16.1 | 9.1 | 27.0 | -6.2 | 2.1 | 13.2 | 10.2 | -3.8 |

| Reference Indicator | 11.1 | 8.9 | -4.8 | 28.9 | 1.8 | 12.9 | -6.6 | 10.5 | 14.2 | -2.4 |

| Carmignac Investissement Latitude | + 9.4 % | + 7.9 % | + 1.6 % |

| Reference Indicator | + 5.4 % | + 10.4 % | + 6.4 % |

Source: Carmignac at 31 Mar 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: 50% MSCI AC World NR index + 50% €STR Capitalized index

Related articles

![[Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress&fit=fill&w=3840)

Carmignac Portfolio Investissement: Letter from the Fund Manager

Carmignac Portfolio Grandchildren: Letter from the Fund Managers

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden