A look at the Merger Arbitrage strategy

A more efficient and diversified approach, especially in current Market configuration

Between 1998 and 2022, Merger Arbitrage strategies delivered a 4.4% annualised return, or about 200bp above the risk-free rate over the same period.1 Capturing the spread from officially announced global Merger & Acquisition deals, Merger Arbitrage strategies provide an alternative approach thanks to its strong decorrelation from traditional asset classes.

Merger Arbitrage strategy is especially suited for current market conditions, as it presents an effective hedge in rising rate or inflationary environment. The strategy often displays a lower volatility compared to stocks with low correlation with traditional asset classes such as equities and bonds.

Merger Arbitrage – Back to basics

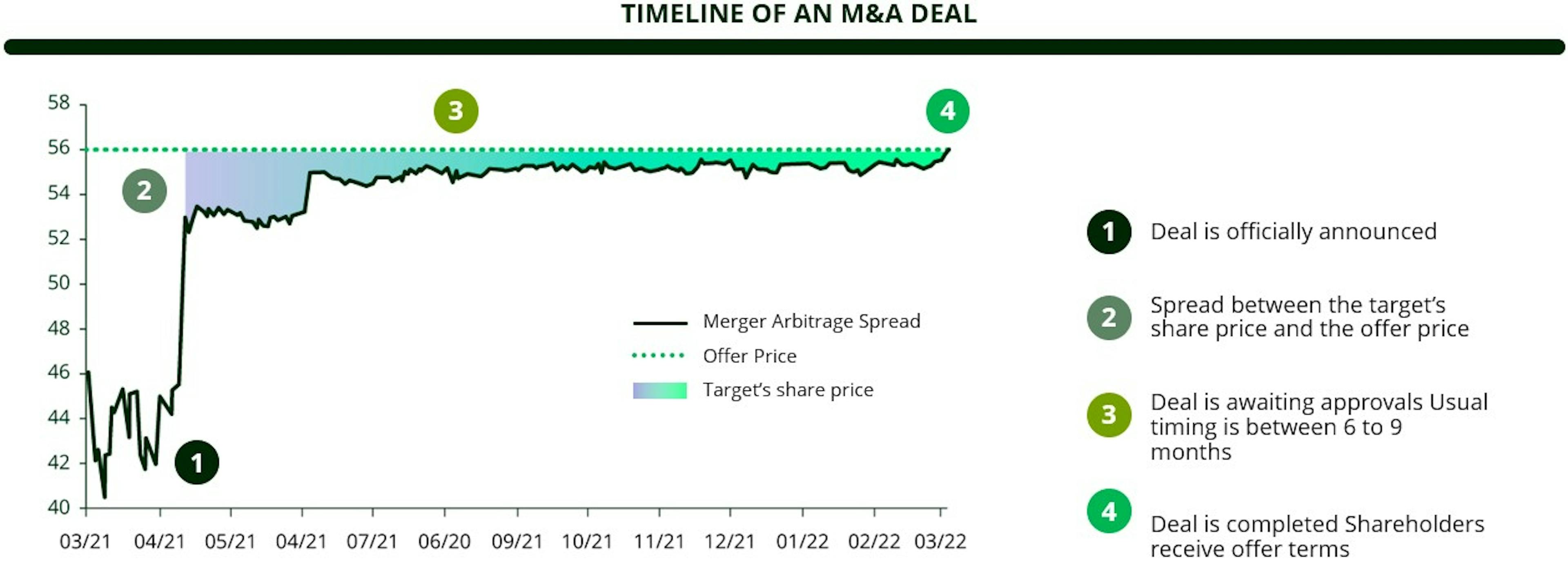

Merger Arbitrage is an alternative strategy whose objective is to take advantage of price discrepancies, observed after the announcement of an M&A (Merger & Acquisition) transaction on a listed company.

After an M&A deal is announced, the stock price of the target company generally sits below the acquirer’s bid price for a period of time. This price discrepancy – called the Merger Arbitrage spread (or discount) – is what Merger Arbitrage investors aim to generate a return from if the deal goes through.

The reason for the spread is simple. A deal that’s just been announced still has a while to go before it’s finalised, because there are a number of hurdles yet to overcome: putting the deal to a shareholder vote, getting approval from antitrust regulators, making sure all agreement terms are met, obtaining financing, and so on.

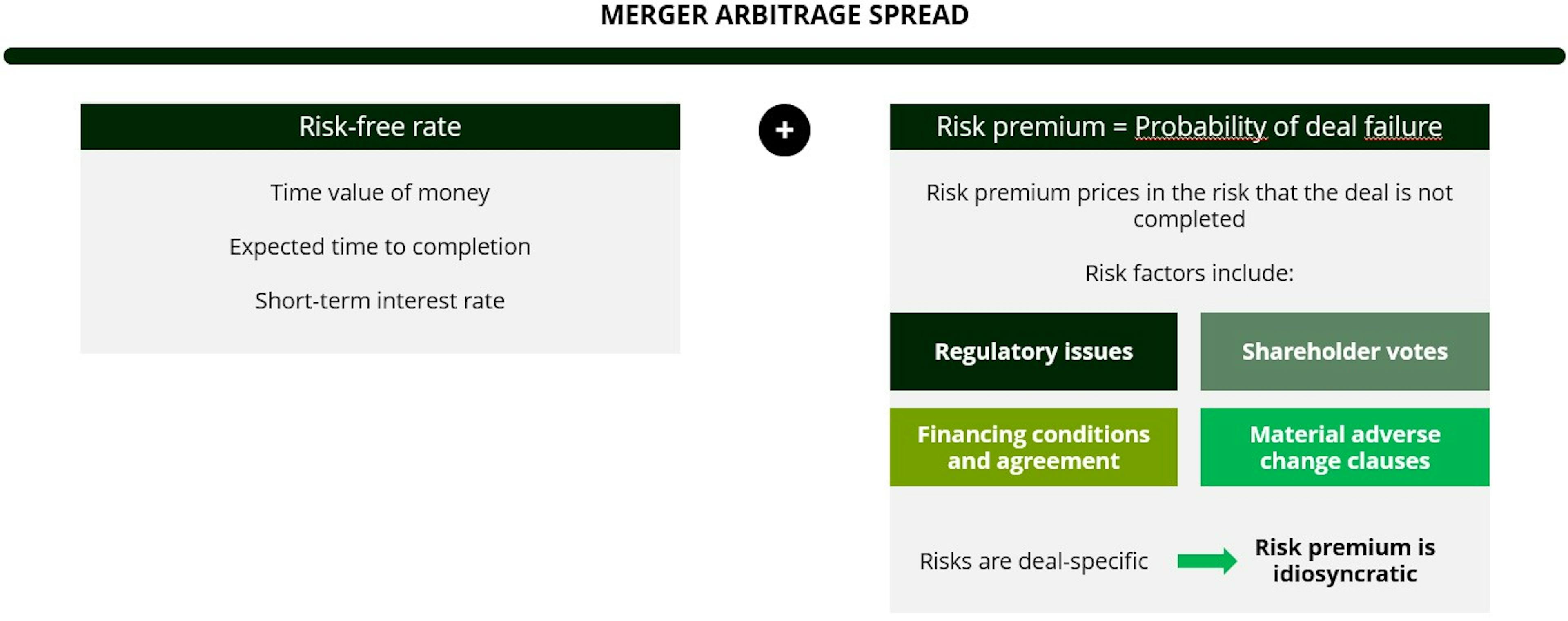

The Merger Arbitrage spread – or the return an investor can expect to receive – is the sum of two factors:

- A risk-free rate, which corresponds to the time value of money between when a deal is announced and when it’s finalised.

- A risk premium associated with the probability of deal failure.

The advantage of a Merger Arbitrage strategy lies in the risk premium. First of all, because the risk is idiosyncratic – the success or failure of an M&A deal depends very little on market conditions and is instead dictated by the fundamentals of the deal in question. And second, because the probability of the risk materialising is very low: over 90% of deals that are officially announced end up being finalised under the initial terms.2

Investors have two ways of capturing a Merger Arbitrage spread. If the deal will be paid for in cash, investors can simply buy stock in the target company. If the deal will be paid for with stock in the acquiring company, investors can buy stock in the target company and at the same time sell stock in the acquiring company under the terms of the offer.

Merger Arbitrage at Carmignac

At Carmignac, we’ve been expanding our alternative-investment capabilities for years and currently manage nearly €2 billion in this asset class. We formed a Merger Arbitrage team and appointed Fabienne Cretin-Fumeron and Stéphane Dieudonné as Fund managers. This move came in response to growing demand from investors seeking to diversify away from conventional asset classes and into those with reduced volatility and uncorrelated returns.

We launched two Merger Arbitrage Funds: Carmignac Portfolio Merger Arbitrage, which has a defensive profile and 2%–4% expected volatility; and Carmignac Portfolio Merger Arbitrage Plus, which is more dynamic and has 5%–7% expected volatility. These funds aim to seize M&A opportunities in the main developed countries. They’re both classified as Article 8 under the SFDR and are open to professional and retail investors in several European countries.

2Sources: Carmignac, Bloomberg at 31 March 2023.

Providing investors an attractive and uncorrelated source of returns to traditional markets

Discover our Alternative RangeCarmignac Portfolio Merger Arbitrage A EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 2/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 1,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 0,96% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,30% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Carmignac Portfolio Merger Arbitrage Plus A EUR Acc

- Recommended minimum investment horizon

- 3 years

- Risk indicator*

- 3/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- 1,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,80% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% max. of the outperformance if the performance is positive and the net asset value exceeds the high-water mark. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,84% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Related articles

Our Merger Arbitrage strategies win ‘Best new launch’ award

Best ESG Alternative Fund award goes to Carmignac

MARKETING COMMUNICATION. Please refer to the KID/prospectus of the fund before making any final investment decisions.

Source: Carmignac, 13/11/2023. This document may not be reproduced, in whole or in part, without prior authorisation from the management company. It does not constitute a subscription offer, nor does it constitute investment advice. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without prior notice. The information contained in this document may be partial information and may be modified without prior notice. The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in English on the following link (paragraph 6): https://www.carmignac.com/en_US/article-page/regulatory-information-1788. The decision to invest in the promoted funds should take into account all their characteristics or objectives as described in their prospectus. Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. Access to the Funds may be subject to restrictions with regard to certain persons or countries. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a U.S. person, according to the definition of the US Regulation S and/or FATCA. The Funds present a risk of loss of capital. The risk, fees and ongoing charges are described in the KIDs (Key Information Document). The Funds' respective prospectuses, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management Company. The KIDs must be made available to the subscriber prior to subscription. The Fund’s respective prospectuses, KIDs and annual reports are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon. The KID must be made available to the subscriber prior to subscription.