Investment adventures in Emerging Markets

First stop: China

Since Carmignac was founded in 1989, we have seen value in investing in emerging markets. We have developed a strong expertise, concentrating our efforts to identify and invest in the best opportunities. Especially within Chinese equities, a focus of our global portfolios since inception.

Each year, our emerging markets fund managers and analysts travel to the countries in which we invest. These visits are crucial. Not only for the team to meet the management of our current and potential portfolio companies but also to get a tangible picture of the day-to-day reality of the businesses (through visiting, manufacturing sites, for example) and to get local insight on the economic developments and major policies of the countries through conversations with local experts, consultants and residents.

From mid-February to March 2023, Carmignac’s EM team travelled to China. This trip was the first in three years due to Covid lockdown and makes Carmignac one of the first developed-market asset managers to get back on the ground!

Here is a summary of their main findings.

Zero covid is behind us

-

Gathering of the elderly in Fuyang City In China, zero-Covid restrictions really are over. In general, masks are only worn in public transport. Whether it is in small villages or big cities, life seems to be back to normal, with people socializing and spending time outside.

-

Flight from Beijing to Guangzhou at 9.30 PM, early March. Traffic is also back to normal and for certain forms of transport, user levels are higher than pre-Covid. However, outbound tourism has not fully recovered, as most people are travelling for business reconnection domestically, rather than outbound tourism (so far).

Despite the Chinese Lunar New Year holiday in late January, where data showed a 23% year-on-year rise in domestic trips during the seven-day period, we believe that China’s reconnection to the rest of the world will take some time and outbound tourism recovery will follow, probably in the second half of 2023.

As an illustration, in March, mainland visitors to Macau rose to 56% of the 2019 level in the first three weeks of March, up from 45% in February, while those to Hong Kong bounced back to ~55% of the 2018 level. International flight capacity has also returned to ~22% of the 2019 level (vs. 14% in Feb-23)1.

Economy: Recovery led by local services

The economic recovery is underway, mostly led by services.

Local consumption (services, hotels and restaurants) seems to have recovered with a strong pick-up in activity.

There is on the ground evidence that consumption will be the main driver of recovery in 2023, with an expected 8%+ rebound2 in 2023 after contracting last year.

-

Source: Bloomberg March 2023 However, the COVID-19 pandemic has significantly impacted the Chinese economy and society. This led to a decline in employment and income as well as a rise in household savings as Chinese households tried to preserve their financial stability in the face of economic uncertainty. As seen in the chart, China’s Consumer confidence index has dropped to a historically low level (reaching a 10-year low point end of November 2022).

And despite the improvement following the reopening, Chinese consumers remain cautious and selective. High-ticket items’ sales are not really picking up, as evidenced by car sales. There is no “revenge spending”, and pick-up for discretionary consumption is slower than expected.

-

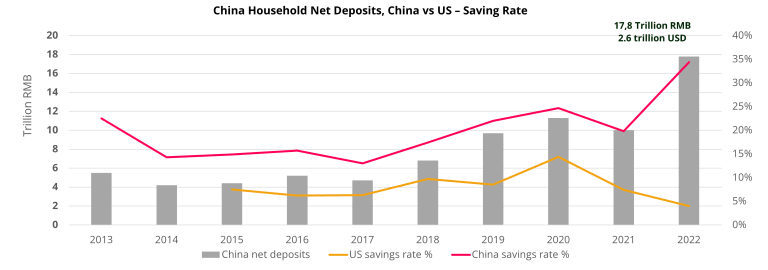

Data from Bloomberg as of 1/31/2023. Chinese household net deposits reached an all-time high of 17.8 trillion RMB ($2.6 Trillion USD) in 2022. Also, China’s household savings rate spiked to 34% in 2022 compared to an 18% historical average prior. By comparison, in 20203, the US recorded a historically high savings rate among its consumers.

However, we witnessed a sharp decrease in the US savings rate as the country accelerated its reopening in 2021, indicating that consumers were ready to spend savings heavily post-COVID. We believe that the trajectory of consumer spending in China will be similar to what we witnessed in the United States and in Europe at the beginning of 2021.

Real Estate: Some more pain before it gets better

While it is too early to have a definite view on the housing recovery, there have been some improvements in data, notably, in home prices and sales picking up and government actions in providing funding, relaxing regulation, lowering mortgage rates. Secondary market transactions will likely post a decent rebound this year.

However, despite these positive developments, we do not see the property market as a future growth engine for China.

Property investments are likely to be down in 2023, after a 10% contraction in 20224. Indeed, low Tier cities which account for 50-60% of construction activity have very still inventories, low demand, and are witnessing population decline. One on-the-ground survey shows that only 20% of unfinished projects of distressed developers have seen construction resuming so far. The funding necessary to finish all those projects is around 8% of GDP4.

Despite the rebound in the secondary market, we believe a property market recovery will be slow, especially for the primary market. This is why, we also believe that Chinese growth will be slow to be transmitted to other emerging markets especially to commodity exporters as in previous cycles.

This comforted us in our view that the property development sector or commodity and materials (cement, steel, iron ore) are certainly not areas to allocate capital in the long run.

Politics: Pragmatism prevails

During our trip, the Two Sessions of the National Party Congress (NPC) took place, during which China's new political lineup and economic growth targets were confirmed.

The NPC’s announcements were not a big surprise. The 5% GDP growth target has somewhat disappointed investors, but economists we met will not change their growth forecast because of that. Furthermore, and perhaps conversely, the lack of spectacular measures to boost consumption or support real estate is actually a positive to the quality of Chinese growth.

Moreover, we see more pragmatism from local governments when applying central government policies in their region. This is also an encouraging development, leading us to think that local governments have learnt from past mistakes and will lead more pragmatic policies when managing local budgets and applying central government policies in their region.

Good debut for Chinese premier Li Qiang

In his public debut, China's new Premier, Li Qiang sought to reassure the private sector and international business community of Beijing's pro-business stance.

Besides providing equal treatment to companies regardless of ownership type and an improving business environment (“a better environment and broader space for development”), the new Premier said he aims to "create an atmosphere of the whole society to respect entrepreneurs" - a rare statement from a Chinese leader.

He also affirmed that China will continue to rely on opening up (and reform) to achieve long-run growth target. In practice this means further aligning with high-standard international business rules and improving public services to foreign enterprises. We find these announcements to be very encouraging.

Institutional reform

NPC has also set up several centralised supervision bureaus:

Although there have been some concerns that the formation of several super agencies will indicate CPC’s stronger control and more government intervention, we think it is too early to know if this is positive or negative. However, we don’t think the formation of super agencies will lead to tighter regulations, and instead it could mark the conclusion of the previous tight regulatory cycle and the normalization of a new regulatory environment.

What is certain is that government intervention and a more concentrated regulatory structure can be good for solving problems and increasing efficiencies of government policies and functions.

Another positive is that Yi Gang will remain head of the central bank and not replaced, as many expected. We believe he has done a very good job by focusing on deleveraging, financial stability, opening up of the CNH.

Further, the HK Stock Connect program, that is very important for local investors, is progressing well. Indeed, local investors cannot buy eligible stocks if it’s not “Connected” as the Qualified Domestic Institutional Investor quota is limited. We expect more and more stocks to be included in Connects, accelerating further China’ financial opening.

Common prosperity and societal changes

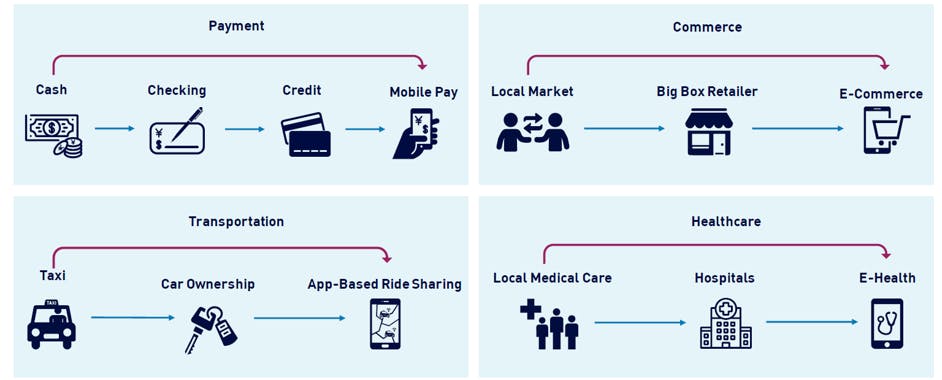

Despite three years of Covid restrictions and lockdowns, it’s clear China did not really slow down its urbanisation. On the contrary, it is much faster and more efficient than most countries. We saw a more urban, cleaner and more digital China than our last visit pre-Covid.

There were also signs that digitalisation is expanding in many areas in terms of sectors and location. Indeed, China’s rapid adoption of new technologies has provided a “leapfrogging” effect, making China is one of the most developed countries in terms of digitalisation.

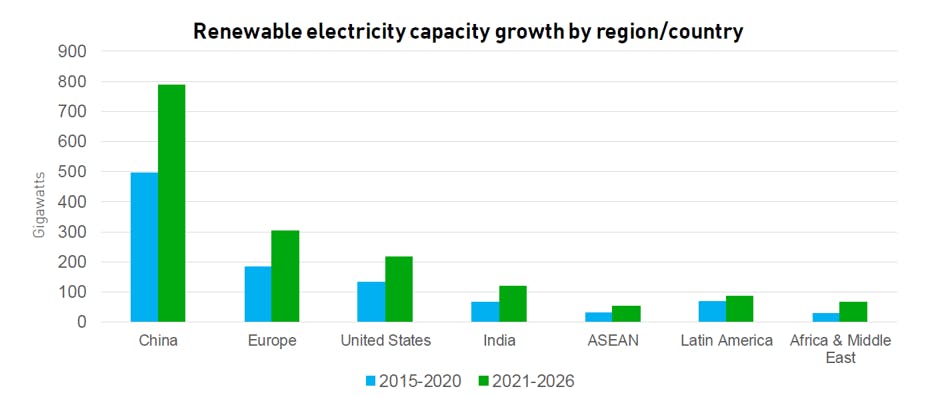

Moreover, environmental protection efforts are seen everywhere. China has become world leader in terms of renewable technology and projects, outpacing other world leaders in growth of electric power capacity from renewable technologies. We believe this will lead to major investment opportunities over the years to come.

The Zhejiang province, where I (Haiyan) come from is the « common prosperity » test province. The results are impressive. Unlike in Europe, where rural areas are less served in terms of infrastructure and digitalization, in China’s rural areas there is impressive progress on building new and modern infrastructure, and also in terms of digitalization for online to offline development (eCommerce, food delivery and ridesharing). Common prosperity has been seen as controversial by Western media but it’s actually very positive for social stability and China’s path to sustainability.

-

However, some problems remain:

The level of local government debt and no immediate visible economic return.

No visible solution for China’s demographic pressure: low willingness of having more than one child. The “three children” policy is not really working so far. Living and education costs remain high. And the tutoring sector reform has not produced the expected effect as parents are still paying much higher cost for one-to-one tutoring.

Geopolitics: Uncertainty ahead

The US and China will remain great rivals. From our exchanges with local experts, the Chinese themselves do not anticipate warming up of relationships between the two countries.

Nevertheless, the US-China decoupling looks structural and negative for China. There doesn’t seem to be a good solution for China’s semiconductor development and our Chinese trip did not give us a lot of comfort in that space.

Taiwan is also a real concern for China and global equities. Chinese equities’ risk premium will remain high given the difficulty to predict the evolution of China/Taiwan relations going forward.

In our allocations, we are avoiding Chinese companies that have a high level of exposure to geopolitical challenges (semiconductors, chip makers,etc..).

Investment conclusions

While the post-pandemic spending bonanza has yet to materialize, slower than expected pick-up in the economy is not necessarily negative for Chinese Equities. We maintain our conviction on the country. Alongside India, China will still be the fastest growing global economy this year with more than 5% growth, and above all, a higher quality growth. Further, the weak employment situation implies that wage pressures will be contained, which supports earnings growth.

Moreover, after two years of sell-off, Chinese companies have attractive valuations, are buying back their shares, increasing dividends and with the recent announcements (Alibaba, JD.com splitting their business into several listed entities) are trying to move in a direction that is going to make their businesses more transparent and better in terms of cash flow generation.

During our trip we also met the management of the companies we are invested in - 15 companies in total (invested and prospects).

Our trip comforted us on our main convictions in China, on their growth prospects and on the quality of the management. Indeed, we prefer companies with strong management who have clear vision and who we believe are able to grow over the years and deliver sustained EPS growth.

The companies we believe are best positioned to benefit in the current environment are:

- Companies withgood supply and demand dynamics in the domestic market.

- Companies able to “go global”. For example, among the Top 10 most downloaded apps worldwide, we find six Chinese companies. We believe this trend is going to continue as more and more Chinese companies try to reach consumers outside of China.

1Sources: China Bureau of Statistics, Bloomberg March 2023

2Sources: Bloomberg, CICC Research estimates, March 2023

3Sources: Bloomberg, March 2023

4Sources: GS Research China, March 2023

5Sources: Bloomberg, company data, as of 31/01/2023

6Sources: Bloomberg, company data, as of 31/03/2023

7Sources: Bloomberg, company data, as of 31/01/2023